Ultimate Guide to Small Business Loans: Eligibility, Requirements, and How to Apply for Maximum Funding

Navigating the world of Small Business Administration (SBA) loans can be overwhelming, but it doesn’t have to be. Whether yrou’re just starting out or looking to expand, understanding the ins and outs of SBA loans is crucial. In this guide, we’ll break down the key aspects of SBA loans, making it easier for you to secure the funding your business needs.

(This is the RESEARCH I found. I am NOT a financial advisor. Read and use at your own will.)

What Are Small Business Loans?

SBA loans are government-backed loans designed to help small businesses secure financing that might be difficult to obtain through traditional lenders. Since the SBA guarantees a portion of the loan, lenders are more willing to offer favorable terms.

However, not all SBA loans are created equal. Let’s dive into the different types available.

Types of Small Business Loans

- 7(a) Loan Program

- Use of Funds: Working capital, equipment, real estate

- Loan Amount: Up to $5 million

- Interest Rate: Prime + 2.25%-4.75%

- Collateral Requirement: Varies by loan amount

- 504 Loan Program

- Use of Funds: Real estate, equipment purchase

- Loan Amount: Up to $5.5 million

- Interest Rate: Fixed rate

- Collateral rRequirement: Yes, up to 100%

- Microloan Program

- Use of Funds: Working capital, inventory, equipment

- Loan Amount: Up to $50,000

- Interest Rate: 6.5%-13%

- Collateral Requirement: No

- Disaster Loan Program

- Use of Funds: Recovery from natural disasters

- Loan Amount: Up to $2 million

- Interest Rate: 3.75% (fixed)

- Collateral Requirement: Varies by loan amount

Eligibility Criteria for Small Business Loans

Before you apply, it’s essential to know whether you qualify for an SBA loan. Although eligibility varies depending on the specific loan, there are general criteria you should be aware of.

- Credit Score: Most SBA loans require a minimum credit score of 620-680.

- Years in Business: Typically, businesses need to be operational for at least 2 years.

- Net Income: There’s no specific requirement, but lendeers will assess your business’s profitability.

- Revenue: No strict requirements, though stable and consistent revenue is favorable.

In addition to these general criteria:

- Collateral: Some SBA loans require collateral, while others do not.

- Personal Guarantee: Most SBA loans require a personal guarantee from the business owner.

Financial Statements and Documentation

Moreover, having the right financial documents on hrand is critical. Here’s a list of what you’ll typically need:

- Balance Sheet

- Profit and Loss Statement (P&L)

- Cash Flow Statement

- Business Tax Returns (last 2-3 years)

- Personal Tax Returns (if personal gurarantee is required)

Additional Documentation:

- Business Plan (especially for new businesses)

- Personal Financial Statement

- Business License

- Environmental Reports (for 504 loans)

- Appraisals (for 504 loans)

- Proof of Disaster Damage (for Disaster Loans)

Application Process

Understanding the application process is key to securing an SBA loan. Although the process can be lengthy, preparing your documentation in advance will save time.

Here’s a step-by-step guide:

- Prepare Your Financial Documents: Gather all necessary financial statements and documentation.

- Choose the Right Loan: Determine which SBA loan best suits your needs.

- Find an SBA-Approved Lender: Work with a lender who has experience with SBA loans.

- Complete the Application: Fill orut the application form, ensuring all information is accurate.

- Submit and Wait: After submission, be prepared to provide additional information if requested.

For more detailed guidance on the SBA loan application process, visit Desiree Lovell’s website for expert advice tailored to your needs.

Ultimate Guide to SBA Loans: Eligribility, Requirements, and How to Apply for Maximum Funding -Helpful Links and Resources for Small Business Loans

- SBA 7(a) Loan Overview

- SBA 504 Loan Overview

- SBA Microloan Overview

- SBA Injury Loan Overview

- The Types of Loans

Additionally, you can find more valuable insights on small busriness loans, SEO strategies, and entrepreneurship by visiting my website Desire Lovell.

Final Thoughts

Securing an SBA loan can be a game-changer for your business. By understanding the various loan types, eligibility criteria, and application process, you’ll be better equipped to make informed decisions. Remember, preparation is key to success, so gather your documents, choose the right loan, and take the next step towards growing your business.I’ll outline the structure and provide the necessary information that should be included. Here’s how the spreadsheet can be organized:

Spreadsheet Structure

Columns:

- Loan Name

- Loan Type

- Credit Score Requirement

- Years in Business Required

- Net Income Requirement

- Revenue Requirement

- Loan Amount Range

- Interest Rate

- Repayment Term

- Use of Funds

- Collateral Requirement

- Personal Guarantee Requirement

- Application Process

- Financial Statements Required

- Additional Documentation Required

- Resource Links

- Notes

Sample Data

Financial Statements Typically Required:

- Balance Sheet

- Profit and Loss Statement (P&L)

- Cash Flow Statement

- Business Tax Returns (usually for the last 2-3 years)

- Personal Tax Returns (if personal guarantee is required)

Additional Documentation Typically Required:

- Business Plan (for new businesses or specific loan types)

- Personal Financial Statement

- Business License

- Environmental Reports (for 504 loans)

- Appraisals (for 504 loans)

- Proof of Disaster Damage (for Disaster Loans)

Resource Links:

- SBA 7(a) Loan Overview: SBA 7(a) Loan Program

- SBA 504 Loan Overview: SBA 504 Loan Program

- SBA Microloan Overview: SBA Microloan Program

- SBA Disaster Loan Overview: SBA Disaster Loan Program

Small Business Loans – Eligibility, Requirements, and How to Apply for Maximum Funding The SpreadSheet:

| Name | Loan Type | Credit Score Requirement | Years in Business Required | Net Income Requirement | Revenue Requirement | Loan Amount Range |

| 7(a) Loan Program | Term Loan | 680+ | 2+ | No specific requirement | No specific requirement | Up to $5 million |

| 504 Loan Program | Term Loan | 680+ | 2+ | No specific requirement | No specific requirement | Up to $5.5 million |

| Microloan Program | Microloan | 640+ | No specific requirement | No specific requirement | No specific requirement | Up to $50,000 |

| Disaster Loan Program | Disaster Loan | 620+ | No specific requirement | No specific requirement | No specific requirement | Up to $2 million |

I Hope You Enjoyed: Ultimate Guide to SBA Loans: Eligibility, Requirements, and How to Apply for Maximum Funding -Leave Your Own Resources for Others in the comments.

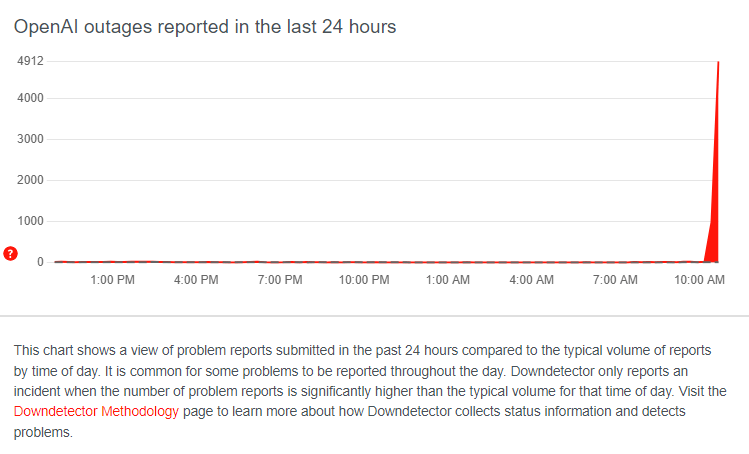

Other helpful tools…if you ever want to know if CHATGPT is down or what your connection speed is…

OOKLA –

https://downdetector.com/status/openai