British economist

The Power of Compounding Interest:

Why the Rich Keep Getting Richer

Compounding interest is often referred to as the “eighth wonder of the world,” and for a good reason. It’s a financial concept that has the power to transform modest savings into significant wealth over time. But why is it that the rich seem to benefit more from compounding interest, making them richer with each passing year? In this article, we’ll explore the mechanics of compounding interest, how it works to amplify wealth, and why it’s a crucial factor in the growing wealth disparity. We’ll also draw insights from Garyseconomic, a popular YouTube channel known for its practical investing advice.

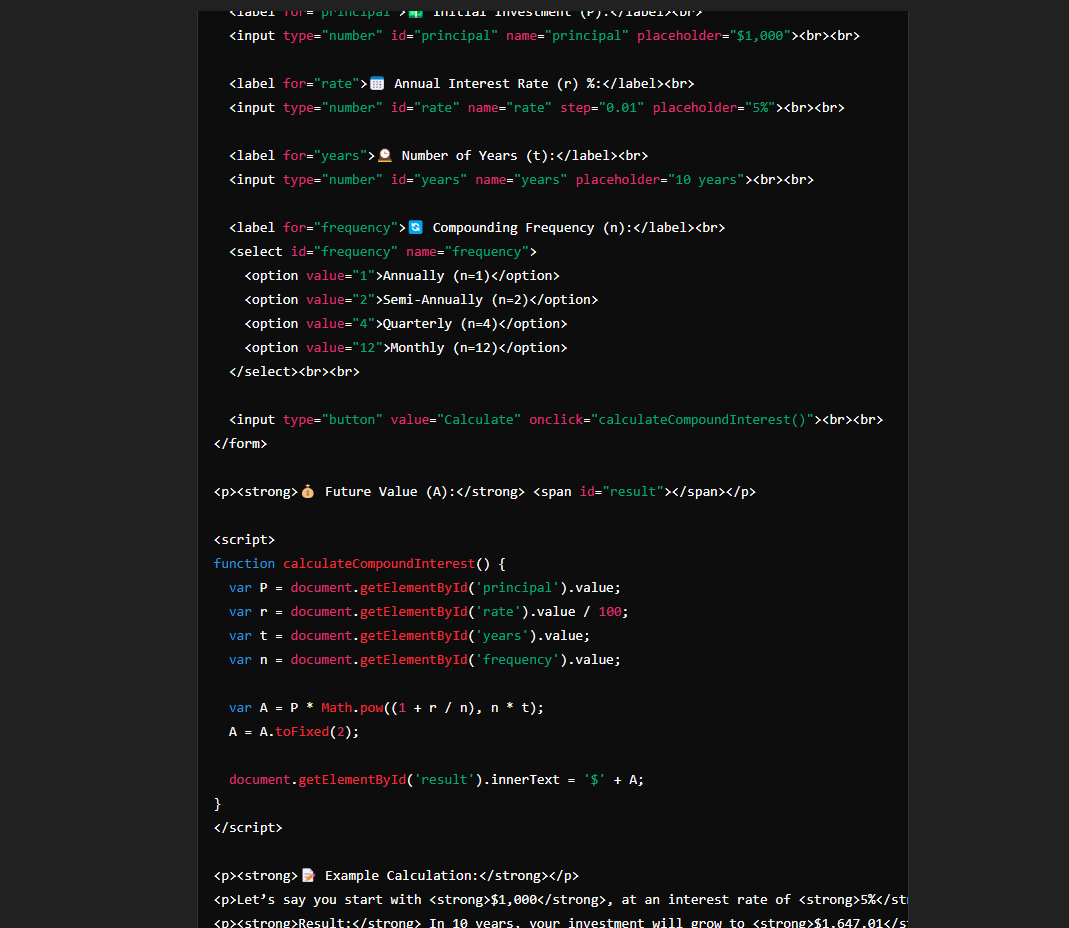

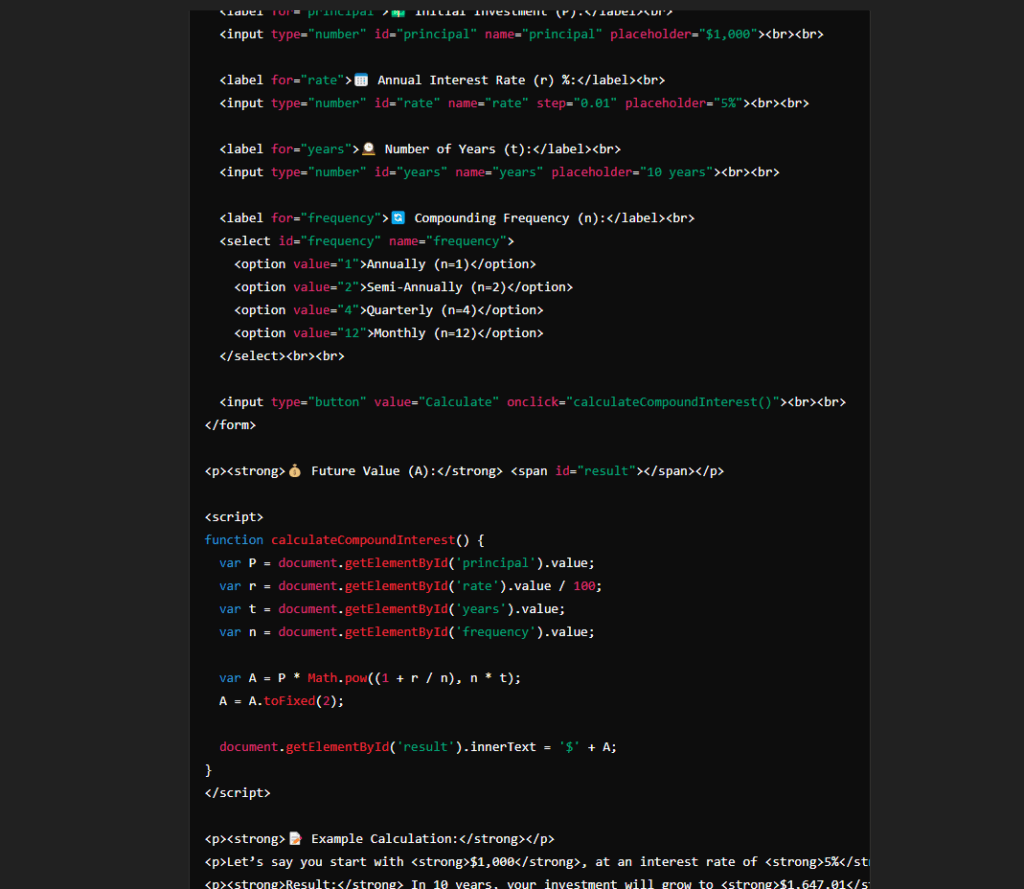

📈 Compounding Interest Calculator

Calculate your future savings easily!

💰 Future Value (A):

📝 Example Calculation:

Let’s say you start with $1,000, at an interest rate of 5% per year, compounded quarterly, over 10 years.

Result: In 10 years, your investment will grow to $1,647.01!

🎉 How It Helps You:

- Know Your Future Savings: See how your money grows over time.

- Plan Better: Adjust your investment amount, interest rate, or time period to meet your financial goals.

- Take Control: Understand how often your interest is compounded to maximize your returns!

✨ Keep Growing Your Wealth! ✨

Understanding Compounding Interest

At its core, compounding interest is the process where the interest earned on an investment is reinvested to earn additional interest. This creates a snowball effect, where your investment grows not just on the principal amount but also on the accumulated interest over time.

Here’s a simple example:

- Initial Investment (Principal): $1,000

- Annual Interest Rate: 5%

- Years Invested: 10

In this scenario, if the interest is compounded annually, your $1,000 would grow to approximately $1,628 after 10 years. The magic of compounding lies in the fact that you’re earning interest on both your initial investment and the interest that accumulates each year.

Why the Rich Get Richer: The Compounding Effect

- Larger Initial Investments Yield Greater Returns:

- Wealthier individuals have the means to make larger initial investments. Even with the same interest rate, a higher principal amount leads to significantly more interest earned. For example, a $100,000 investment at the same 5% interest rate would grow to approximately $162,889 in 10 years. The more money you have to invest, the more you stand to gain from compounding interest.

- Access to Higher-Yield Investments:

- The rich often have access to exclusive investment opportunities that offer higher returns. Whether it’s real estate, private equity, or high-yield bonds, these investments typically aren’t available to the average person. Higher yields mean more interest, which, when compounded, accelerates the growth of wealth.

- Time Is on Their Side:

- Wealthier individuals often start investing earlier, giving their money more time to grow. Compounding interest is exponentially more powerful over long periods. The earlier you start, the more significant the growth, and the rich, who often have the means to invest early, can let their investments grow uninterrupted for decades.

- Reinvestment and Patience:

- The wealthy understand the importance of reinvesting earnings and letting the power of compounding work over time. Instead of withdrawing their interest or dividends, they reinvest them, allowing their wealth to grow exponentially. Patience is key, and those who can afford to leave their money untouched benefit greatly from compounding.

Insights from Garyseconomic on YouTube

Garyseconomic, a popular YouTube channel focusing on practical investing advice, often emphasizes the importance of compounding interest in wealth-building. Gary, the channel’s host, provides a deep dive into how even small, consistent investments can grow significantly over time if left to compound.

One of Gary’s key messages is that it’s never too late to start investing, but the earlier you begin, the more you can take advantage of compounding interest. He also discusses the strategies used by wealthy individuals, including the importance of diversifying investments to optimize returns and minimize risk.

Gary’s videos are a valuable resource for anyone looking to understand the nuances of investing and how to harness the power of compounding interest. He breaks down complex financial concepts into easy-to-understand language, making it accessible for everyone.

Why You Should Start Investing Today

The concept of compounding interest is not exclusive to the wealthy. Anyone can benefit from it, but it requires discipline, patience, and a long-term perspective. Even small investments can grow significantly if given enough time.

Here are some tips to get started:

- Start Early: The earlier you start, the more time your investments have to compound.

- Be Consistent: Make regular contributions to your investment accounts, even if they’re small.

- Reinvest Earnings: Avoid the temptation to spend the interest or dividends; reinvest them to take full advantage of compounding.

- Educate Yourself: Channels like Garyseconomic offer a wealth of knowledge on investing strategies and the power of compounding interest. Make use of these free resources to grow your understanding.

Conclusion

Compounding interest is a powerful force that can significantly amplify wealth over time. While it often seems like the rich get richer simply because they have more money, the truth is that they understand and leverage the power of compounding interest to their advantage. By starting early, making consistent investments, and reinvesting earnings, anyone can harness this financial phenomenon to build their wealth.

For more in-depth insights and practical investing advice, be sure to check out Garyseconomic on YouTube. The channel offers valuable lessons that can help you make informed decisions and maximize the benefits of compounding interest in your financial journey.

This article explains the mechanics of compounding interest, its impact on wealth accumulation, and how individuals can use it to their advantage, with references to the educational content provided by Garyseconomic on YouTube.

📈 Compounding Interest Calculator

Calculate your future savings easily!

💰 Future Value (A):

📝 Example Calculation:

Let’s say you start with $1,000, at an interest rate of 5% per year, compounded quarterly, over 10 years.

Result: In 10 years, your investment will grow to $1,647.01!

🎉 How It Helps You:

- Know Your Future Savings: See how your money grows over time.

- Plan Better: Adjust your investment amount, interest rate, or time period to meet your financial goals.

- Take Control: Understand how often your interest is compounded to maximize your returns!

✨ Keep Growing Your Wealth! ✨

📈 Compounding Interest Calculator

Calculate your future savings easily!

- 💵 Initial Investment (P): Enter the amount of money you are starting with.

- Example:

$1,000

- Example:

- 📅 Annual Interest Rate (r): Enter the interest rate per year (as a percentage).

- Example:

5%

- Example:

- 🕰️ Number of Years (t): Enter the number of years you plan to invest.

- Example:

10 years

- Example:

- 🔄 Compounding Frequency (n): Choose how often the interest is compounded.

- Options:

Annually (n=1)Semi-Annually (n=2)Quarterly (n=4)Monthly (n=12)

- Example:

Quarterly (n=4)

- Options:

🧮 Formula:

A=P(1+rn)ntA = P \left(1 + \frac{r}{n}\right)^{nt}A=P(1+nr)nt

- A = The amount of money accumulated after n years, including interest.

- P = Initial principal (the amount of money you start with).

- r = Annual interest rate (in decimal form, e.g., 5% = 0.05).

- n = Number of times that interest is compounded per year.

- t = Time the money is invested for in years.

📝 Example Calculation:

Let’s say you start with $1,000, at an interest rate of 5% per year, compounded quarterly, over 10 years.

A=1000(1+0.054)4×10A = 1000 \left(1 + \frac{0.05}{4}\right)^{4 \times 10}A=1000(1+40.05)4×10

A=1000(1+0.0125)40A = 1000 \left(1 + 0.0125\right)^{40}A=1000(1+0.0125)40

A=1000(1.0125)40A = 1000 \left(1.0125\right)^{40}A=1000(1.0125)40

A \approx $1,647.01

Result: In 10 years, your investment will grow to $1,647.01!

🎉 How It Helps You:

- Know Your Future Savings: See how your money grows over time.

- Plan Better: Adjust your investment amount, interest rate, or time period to meet your financial goals.

- Take Control: Understand how often your interest is compounded to maximize your returns!

https://www.nerdwallet.com/article/investing/10-questions-ask-financial-advisor

💰 Investment Fee Calculator

💰 Investment Fee Calculator

Estimate how much you would owe in fees when investing with Facet, Vanguard Personal Advisor, or Harness Wealth.