Lower Fed Rates and the REST OF US

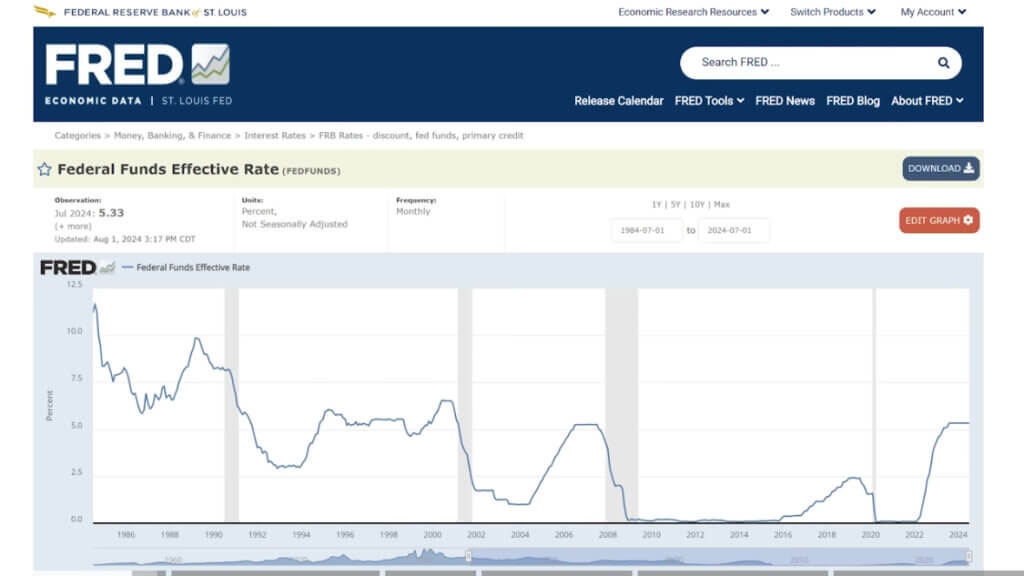

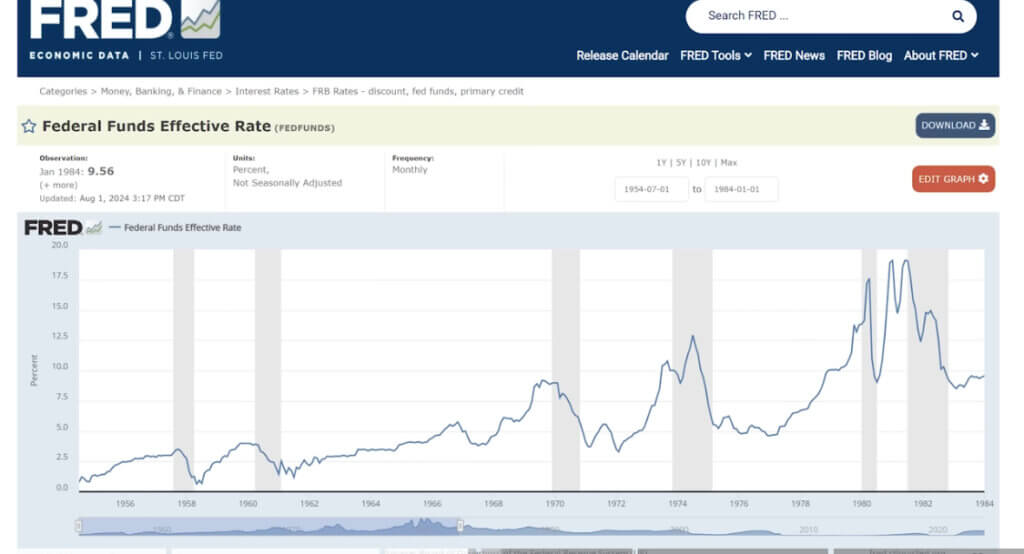

The Federal Reserve’s decision to lower the federal funds rate over the next six months could have several effects on the average American. Here are ten key takeaways:

1. Lower Borrowing Costs

Lower interest rates often translate to reduced costs for loans, such as mortgages, car loans, and personal loans. This could make it easier and cheaper for Americans to borrow money, encouraging spending and investment.

2. Reduced Credit Card Interest

Credit card interest rates are often tied to the federal funds rate. As rates decrease, Americans may see lower interest charges on revolving credit card balances, potentially helping those with debt manage their finances more effectively.

3. Mortgage Refinancing Opportunities

Homeowners might benefit from lower mortgage rates, making it more appealing to refinance existing mortgages. Lower rates can reduce monthly payments, freeing up income for other expenses or savings.

4. Boost in Housing Market

Lower interest rates can spur demand for housing, as mortgages become more affordable. This could lead to increased home purchases, a stronger real estate market, and potentially rising home prices.

5. Savings Account Yields May Decline

On the downside, lower rates often mean less interest earned on savings accounts, certificates of deposit (CDs), and money market accounts. For those who rely on interest income, this could reduce their earnings from savings.

6. Potential for Inflation

With lower rates encouraging spending and borrowing, demand for goods and services may increase, potentially leading to higher prices. Inflation could erode purchasing power, impacting the cost of living.

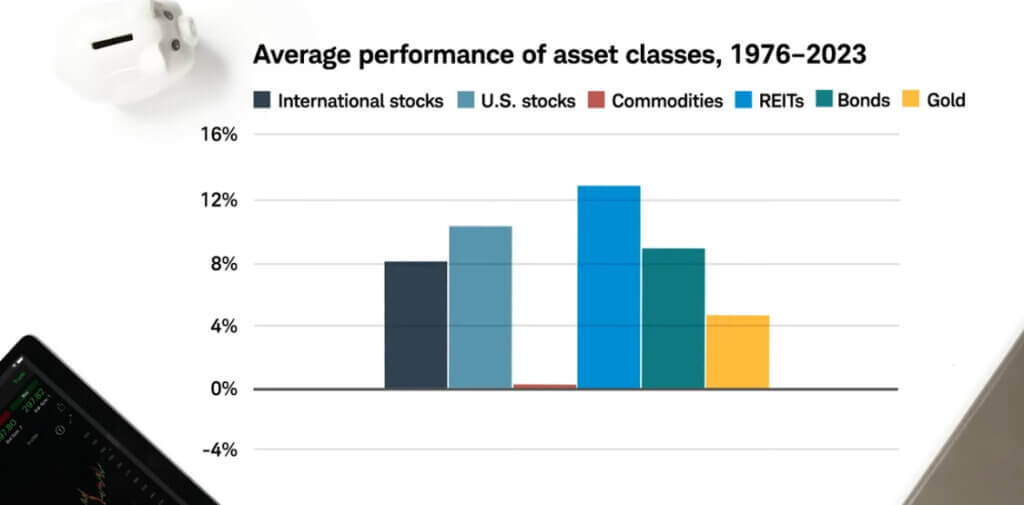

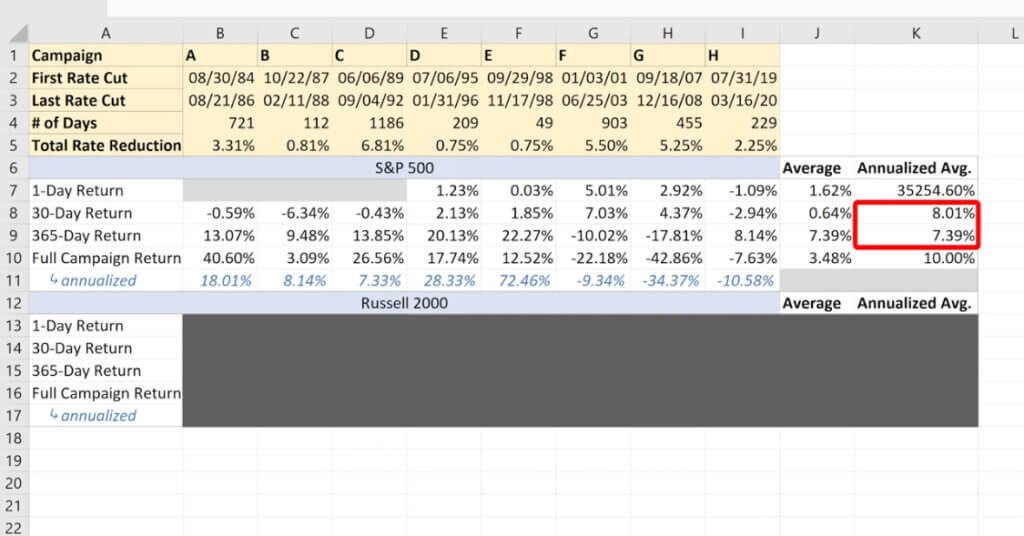

7. Stock Market Gains

Lower rates tend to make stocks more attractive as investments, potentially driving up the stock market. Those with investments in the stock market, including retirement accounts, could see their portfolios increase in value.

8. Corporate Borrowing and Expansion

With lower borrowing costs, companies may invest in growth and expansion, which can create jobs and increase wages. This can have a positive effect on the broader economy, potentially benefiting American workers.

9. Encouragement of Consumer Spending

Lower rates generally encourage consumer spending, as borrowing becomes cheaper. This can stimulate economic growth, but it may also lead to more debt for individuals who take advantage of easier access to credit.

10. Economic Stimulus and Recession Prevention

Lowering interest rates is often used as a tool to stimulate the economy, particularly during periods of economic slowdown. By making credit cheaper, the Fed aims to boost spending and investment, helping to avert a potential recession and support economic stability for the average American.

In summary, while lower interest rates can provide financial relief through cheaper loans and investment opportunities, they may also lead to reduced savings returns and potential inflation risks. For the average American, the impact will vary depending on their financial habits and circumstances.

I think HOMELESSNESS WILL RISE DRASTICALLY and Job/Unemployment as well…

Hearing They Are Worried About Jobs, too.

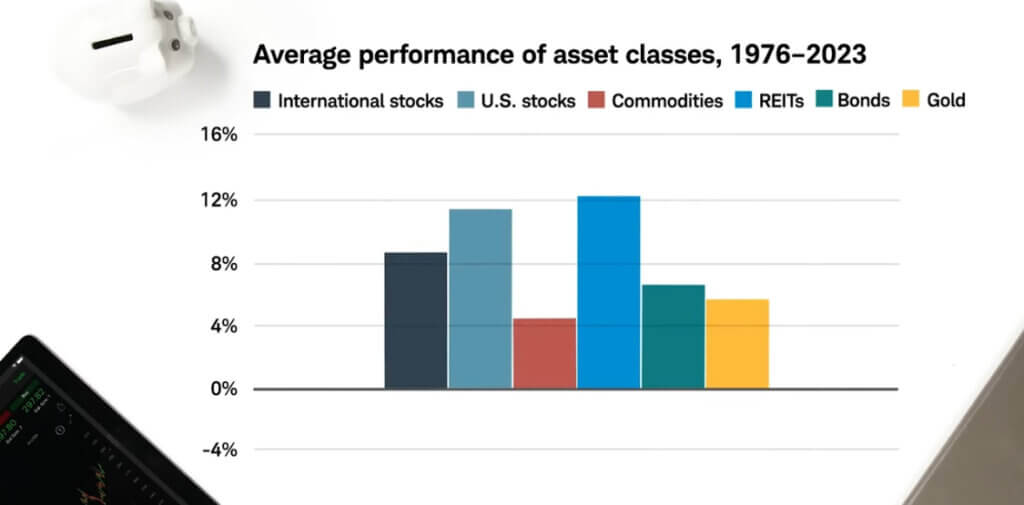

GOLD GOLD