Our New CRYPTO CZAR…

This is Adrei Jikh’ VIDEO

Opinions expressed are based upon information considered reliable, but this Youtube channel does not warrant its completeness or accuracy, and it should not be relied upon as such.

IMPACT ON TAXPAYERS

The Possible Impact on Taxpayers and US Citizens

Understanding Digital Assets: Definitions and Implications

The rise of blockchain technology and decentralized finance has introduced a new lexicon of digital assets, including digital commodities, digital currency, digital securities, and digital tokens. Each of these categories represents a distinct type of asset with unique characteristics and regulatory implications. As the United States continues to grapple with the ownership and regulation of cryptocurrencies and other digital assets, the potential effects on taxpayers and citizens are significant. Below, we define and illustrate these concepts, followed by an analysis of the potential positive and negative impacts of U.S. crypto ownership on the general public.

1. Digital Commodities

- Definition: Digital commodities are digital assets that derive their value from their utility or scarcity, similar to traditional commodities like gold or oil. They are often used as inputs for decentralized applications (dApps) or as a store of value.

- Examples: Bitcoin (BTC) and Ethereum (ETH) are often classified as digital commodities because they function as decentralized, blockchain-based assets with intrinsic value derived from their utility and limited supply.

- Regulation: In the U.S., digital commodities are typically regulated by the Commodity Futures Trading Commission (CFTC), which oversees commodity derivatives markets.

2. Digital Currency

- Definition: Digital currency refers to any currency that exists purely in digital form and is used as a medium of exchange. It can be centralized (issued by a central authority) or decentralized (operating on a blockchain).

- Examples: Central Bank Digital Currencies (CBDCs), such as the proposed digital dollar, and decentralized cryptocurrencies like Bitcoin and Litecoin (LTC).

- Regulation: Digital currencies are subject to oversight by multiple U.S. agencies, including the Securities and Exchange Commission (SEC), the Internal Revenue Service (IRS), and the Financial Crimes Enforcement Network (FinCEN).

3. Digital Securities

- Definition: Digital securities are blockchain-based representations of traditional financial instruments, such as stocks, bonds, or derivatives. They often provide ownership rights or entitlements to profits, dividends, or interest payments.

- Examples: Security tokens issued through Initial Coin Offerings (ICOs) or Security Token Offerings (STOs), which represent equity in a company or a share of its profits.

- Regulation: Digital securities fall under the jurisdiction of the SEC, which enforces compliance with federal securities laws to protect investors.

4. Digital Tokens

- Definition: Digital tokens are a broad category of blockchain-based assets that can serve various purposes, including utility, governance, or access to specific services within a decentralized ecosystem.

- Examples: Utility tokens like Filecoin (FIL), which provide access to decentralized storage, or governance tokens like Uniswap (UNI), which allow holders to vote on protocol changes.

- Regulation: The regulatory treatment of digital tokens depends on their function. Utility tokens may not be classified as securities, while governance tokens could fall under SEC oversight if they resemble investment contracts.

Potential Effects of U.S. Crypto Ownership on Taxpayers and Citizens

As the U.S. government and private sector increasingly adopt and regulate cryptocurrencies, the implications for taxpayers and citizens are multifaceted. Below, we explore the potential positive and negative effects:

Positive Effects

- Economic Growth and Innovation:

- The adoption of digital assets can spur innovation in financial technology, creating new industries and job opportunities. This could lead to economic growth and increased tax revenue for the government.

- Financial Inclusion:

- Cryptocurrencies and digital assets can provide access to financial services for unbanked or underbanked populations, fostering greater financial inclusion and economic participation.

- Efficiency in Transactions:

- Blockchain technology enables faster, cheaper, and more transparent transactions, reducing costs for businesses and consumers alike.

- Investment Opportunities:

- Digital assets offer citizens new avenues for investment and wealth generation, potentially diversifying portfolios and increasing financial resilience.

- Global Competitiveness:

- By embracing digital assets, the U.S. can maintain its position as a global leader in financial innovation, attracting investment and talent from around the world.

Negative Effects

- Regulatory Uncertainty:

- The lack of clear and consistent regulations can create confusion for taxpayers and businesses, leading to compliance challenges and potential legal risks.

- Tax Complexity:

- The IRS treats cryptocurrencies as property, requiring taxpayers to report capital gains and losses on every transaction. This creates a significant administrative burden and increases the risk of errors or audits.

- Market Volatility:

- The highly volatile nature of digital assets can lead to significant financial losses for investors, potentially destabilizing household finances and the broader economy.

- Security Risks:

- The decentralized and pseudonymous nature of cryptocurrencies makes them attractive targets for hackers, scammers, and fraudsters, posing risks to individual and institutional investors.

- Environmental Concerns:

- The energy-intensive process of mining certain cryptocurrencies, such as Bitcoin, raises environmental concerns, potentially leading to increased regulatory scrutiny and public backlash.

- Wealth Inequality:

- Early adopters of cryptocurrencies have disproportionately benefited from their appreciation, potentially exacerbating wealth inequality and creating a new class of “crypto elites.”

Conclusion

The ownership and regulation of digital assets in the United States present both opportunities and challenges for taxpayers and citizens. On the one hand, digital commodities, currencies, securities, and tokens can drive innovation, financial inclusion, and economic growth. On the other hand, regulatory uncertainty, tax complexity, market volatility, and security risks pose significant challenges that must be addressed.

To maximize the benefits and mitigate the risks, policymakers must strike a balance between fostering innovation and protecting consumers. Clear and consistent regulations, robust consumer protections, and public education initiatives will be essential to ensuring that the U.S. remains at the forefront of the digital asset revolution while safeguarding the interests of its citizens.

As the digital asset landscape continues to evolve, taxpayers and citizens must stay informed and proactive in understanding the implications of this transformative technology. By doing so, they can navigate the complexities of digital ownership and contribute to a more inclusive and resilient financial system.

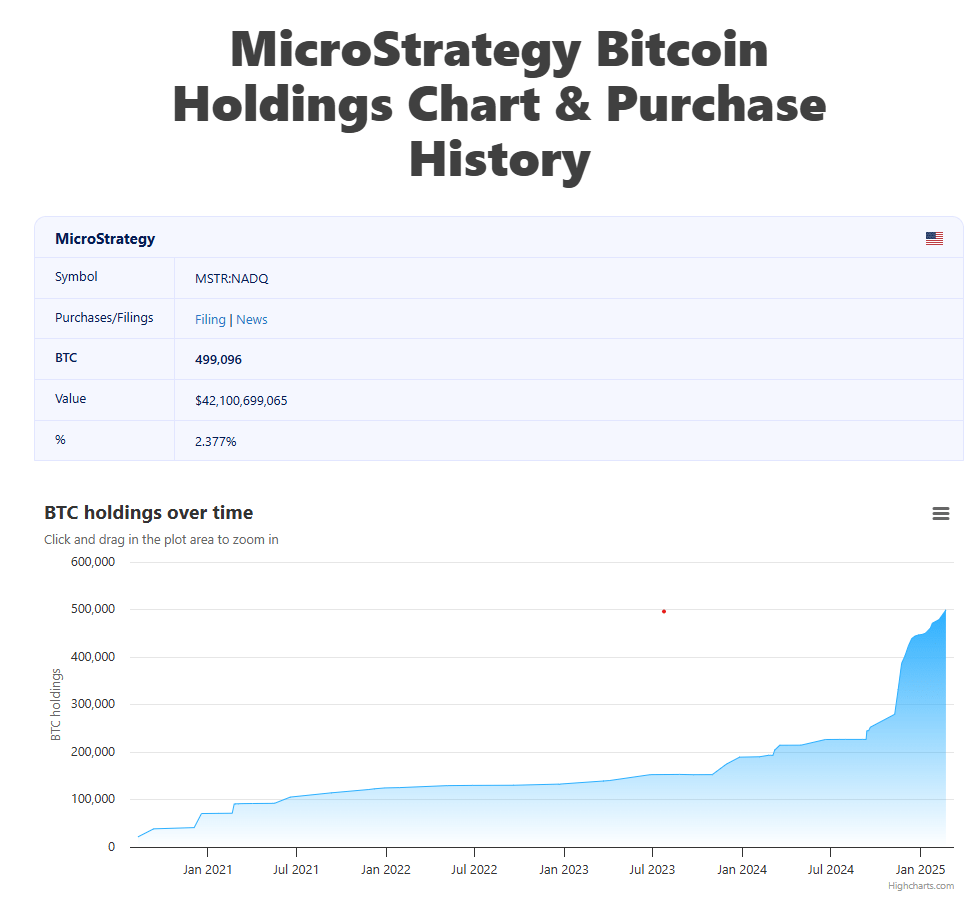

https://treasuries.bitbo.io/microstrategy

THERE IS NO guarantee EVER, Guaranteed! 🔥🤔🔥

El Salvador — IMF says NO!

According to the report, El Salvador must liquidate the Bitcoin trust fund Fidebitcoin, which was previously used to acquire BTC. The country is also required to present Chivo’s financial statements, audited by an independent crypto-experienced auditor, with this process and audit to be completed before July 2025 for its second review.

One of the most anticipated projects was the Bitcoin Bonds, intended to finance Bitcoin mining infrastructure and the development of Bitcoin City. However, the IMF has now rejected these bonds.

To meet the IMF’s quantitative performance criteria, the fund explicitly states that the public sector is prohibited from issuing or guaranteeing “any type of debt or tokenized instrument that is indexed to or denominated in Bitcoin and implies a liability for the public sector.”

With the Bitcoin Law amendments and the announced end of El Salvador bitcoin accumulation, the narrative about Bitcoin and the Central American country is under a transformation.

Add on Instagram: @GPStephan GET MY WEEKLY EMAIL MARKET RECAP NEWSLETTER: http://grahamstephan.com/newsletter Recently, proposals have called for “A Bitcoin Reserve” that could potentially be used as a hedge against inflation, and a long-term store of value – if the United States accumulates enough of it. THE PROBLEMS: Critics argue Cryptocurrency doesn’t quite have ‘an essential use case,’ as in – it won’t directly help support the economy in times of turmoil Second: In the event of a price drop, the government might be expected to intervene – or, continue buying in to keep the price elevated. Third: Some people have voiced concerns about whether Cryptocurrency would benefit the country, as a whole – or simply provide an economic backstop to private investors who want a high return on their investment. Fourth: A security issue would be absolutely disastrous. However, proponents of a ‘Strategic Reserve’ say that it should JUST include Bitcoin. For example, the CEO of Coinbase tweeted: “Just Bitcoin would probably be the best option — simplest, and clear story as successor to gold…If folks wanted more variety, you could do a market cap-weighted index of crypto assets to keep it unbiased. But probably option #1 is easiest.” Tyler Winklevoss said that other cryptocurrencies aren’t suitable for a reserve, and that – only ONE digital asset in the world right now meets the bar… and that digital asset is Bitcoin.” In terms of WHY Bitcoin has value, Investopedia notes six attributes that all successful currencies MUST have:

- Scarcity

- Divisibility

- Acceptability

- Portability

- Durability

- Uniformity

and that needs to be considered, since – up until now, its followed the overall trend of the NASDAQ.As it turns out, Bitcoin ranked highest in every single category, with the exception of being issued by a Government (which, one could argue is actually for the best). It’s for THAT very reason that so many people see Bitcoin as a beacon of freedom and a way to break away from traditional finance. All of this gives perfect reason for the United States to create their own Reserve, scoop up as much Bitcoin as they can, and then – use that to back the dollar. So, while something like Bitcoin has it’s purpose and it could ONE DAY be worth a lot of money – for the near future, it’s going to behave similar to nearly every other ‘stock market investment’ – and that needs to be considered, since – up until now, its followed the overall

…

For FULL VIDEO: https://youtu.be/pQBzL7tOYG4?si=cWWJmh9MgxTGeJ2R

THIS is WHAT AI STATES after my prompt after reading the:

The White House March 6, 2025 CREATING A STRATEGIC BITCOIN RESERVE AND DIGITAL ASSET STOCKPILE: Today, President Donald J. Trump signed an Executive Order to establish a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile, positioning the United States as a leader among nations in government digital asset strategy…the leader in the field.” President Trump promised to create a Strategic Bitcoin Reserve and a Digital Assets Stockpile. President Trump appointed a “crypto czar” and is hosting the first-ever crypto summit at the White House, just a few of the many ways this Administration is demonstrating its strong commitment to this digital asset.

📰 Simple Breakdown of the Article: Strategic Bitcoin Reserve & U.S. Digital Asset Stockpile 🚀

What’s Happening?

- 🖋️ Executive Order Signed: President Trump signed an order to create a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile.

- 💼 Goal: Make the U.S. a global leader in managing digital assets like Bitcoin.

Key Points for Everyday People 💡

- Bitcoin as a Reserve Asset 💰

- The U.S. will treat Bitcoin like gold or other valuable reserves.

- Bitcoin seized from criminals or civil cases will be stored in this reserve.

- 🚫 No Selling: The government won’t sell this Bitcoin; it’s a long-term store of value.

- No Extra Costs for Taxpayers 🤑

- The government will not spend taxpayer money to buy more Bitcoin.

- Any new Bitcoin will come from forfeitures or budget-neutral strategies.

- Digital Asset Stockpile 📦

- Other digital assets (not Bitcoin) seized by the government will be stored here.

- The Treasury may sell these assets if needed, but won’t buy more.

- Better Management of Crypto 🔒

- Right now, crypto seized by different agencies is scattered and not well-managed.

- This order centralizes control, ensuring better oversight and tracking.

- U.S. as the Crypto Leader 🌍

- President Trump wants the U.S. to be the #1 crypto hub in the world.

- He’s hosting a White House Crypto Summit and appointed a “Crypto Czar” to lead the charge.

Why Does This Matter? 🤔

- Bitcoin is called “digital gold” because it’s scarce (only 21 million coins) and secure.

- The U.S. already holds a lot of Bitcoin but hasn’t used it strategically.

- Past sales of seized Bitcoin cost taxpayers $17 billion in lost value.

- This move aims to maximize the value of crypto assets for the country.

3 Important Questions to Consider ❓

- What happens if Bitcoin’s value drops?

- If Bitcoin loses value, will this reserve hurt the U.S. financially?

- How will this affect everyday taxpayers?

- Will this move benefit regular people, or is it mostly for big investors and the government?

- Is this safe for the economy?

- Cryptocurrencies are volatile. Is it risky for the government to rely on them as a reserve asset?

TLDR 🚀

The U.S. is creating a Bitcoin Reserve and Digital Asset Stockpile using seized crypto. No taxpayer money will be spent, and the goal is to make the U.S. the global leader in crypto. But is it safe, and how will it affect you? 🤷♂️

My PROMPT: You are a financial adviser expert representing the everyday median income taxpayer – Read this article and point out thing in a simple and easy to read manner using emojis and bullet points for the everyday simple person to read and digest, the ask three important questions the read should consider:

Look over the 3 Questions Above and Leave Your Opinions, answers, and insight…it is MUCH appreciated!